Do you want to register your First Company in India? Ask Any question related to Company Formation and we are happy to answer your queries.

A Private Limited Company (Pvt Ltd Co.)is an entity which limits the liability of its owner and restricts the transfer of its shares. It is owned by Non-governmental organsiations or by a small shareholder group. It has certain features:

Under Pvt Ltd Company: Categories comes:

![]() Identity proof of Directors- PAN/Aadhar/Driving License/Passport

Identity proof of Directors- PAN/Aadhar/Driving License/Passport

![]() Proof of address of Directors- Latest Electricity Bill/Latest Telephone Bill/ Rent Agreement/ Bank Account statements having address.

Proof of address of Directors- Latest Electricity Bill/Latest Telephone Bill/ Rent Agreement/ Bank Account statements having address.

![]() Passport Size of Photographs of all Proposed Directors

Passport Size of Photographs of all Proposed Directors

![]() Proof of address of Company: Rent Agreement if rented/ Latest Electricity and Telephone bill in case of owned Property.

Proof of address of Company: Rent Agreement if rented/ Latest Electricity and Telephone bill in case of owned Property.

Rebus was founded in 2017 so with years of experience, our team ensures accurate filings, Fast approval with expert guidance while staying fully compliant.

We believe in no surprises. You’ll always know what you’re paying for with clear & upfront pricing.

Join a community of satisfied clients who trust Rebus for their Company Registration and annual return filings with MCA.

we have got 5 star rating on Google reviews which shows our credibility and authenticity.

We maintain highest level of secrecy of data of client and don’t share with any platform. Entire Team of Rebus has signed non disclosure agreements

Our work meets accuracy and expertise; takes the weight off clients’ shoulder and leaves them delighted with the result.

Ready to Experience the Rebus Difference?: Request a Call back

Get Started with Rebus Today!

Whether you’re a small business or a large enterprise, our Certified Professionals are ready to help you streamline your Company Registration needs. Don’t leave your Company Registration service to chance—partner with Rebus and enjoy peace of mind knowing you’re in expert hands. Contact us today to get a free quote at +919138077750 or mail us at info@rebus.co.in

Let Rebus be your partner in hassle-free and Expert Company Registration services. Ready to experience top-notch service? Contact Us Today!

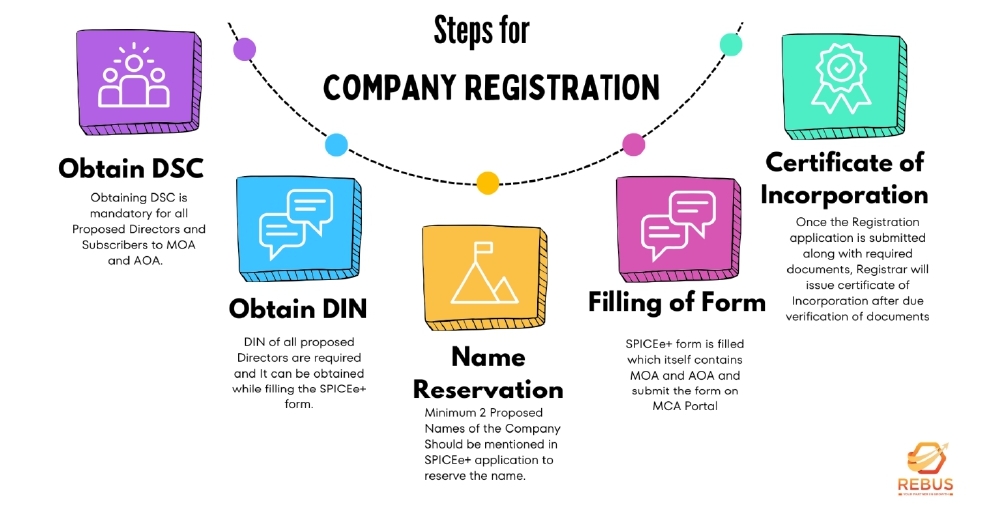

To obtain a DSC, you need to apply with your identity and address proofs, and once verified, the DSC will be issued, allowing you to digitally sign documents.

Yes, non-residents can form a company in India, but they need at least one resident director. The non-resident directors must also comply with DIN and DSC requirements and adhere to FDI guidelines.

You can obtain a DIN by filing Form DIR-3 on the Ministry of Corporate Affairs (MCA) website. You will need to provide your personal details, proof of identity, and proof of address, and the form must be signed using your Digital Signature Certificate (DSC).

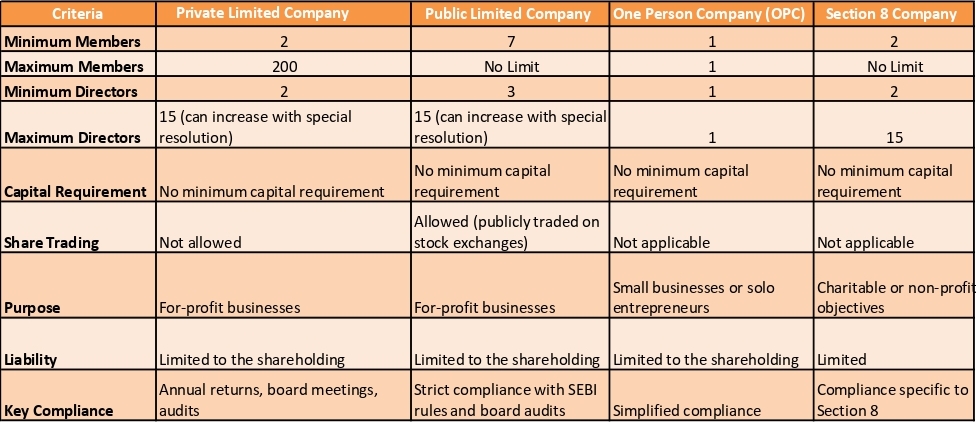

As of now, there is no minimum capital requirement for forming a private limited company or a one-person company in India. However, Company Should have sufficient funds for the business needs.

After incorporation, companies must comply with various legal requirements, including holding annual general meetings (AGM), filing annual returns and financial statements, maintaining statutory registers, and complying with tax regulations.

The chosen name should be unique and should not infringe on any existing trademarks. It must comply with the guidelines set by the Ministry of Corporate Affairs (MCA), including the avoidance of prohibited words and obtaining necessary approvals for specific words.

Converting a partnership firm into a private limited company involves several steps, including obtaining a new certificate of incorporation, transferring assets and liabilities, updating bank accounts, and notifying all relevant authorities and stakeholders.

The ROC is responsible for the registration and regulation of companies in India. They ensure companies comply with statutory requirements, maintain records, and oversee the incorporation process.

To protect your IPR, you should register your trademarks, patents, and copyrights with the respective authorities. This ensures legal protection against unauthorized use and helps in building a strong brand identity.

Companies in India are subject to various taxes, including corporate tax, Goods and Services Tax (GST), and other statutory levies. It’s crucial to understand the tax structure and ensure compliance with all tax-related obligations to avoid penalties.

Office No. 2A, Ground Floor, Vatika First India Place Building, MG Road, Near MG Road Metro Station, Gurugram, Haryana - 122002, India

DSS-59, Near Bikaner Sweets Pushpa Complex, Urban Estate - II, Delhi Road, Hisar -125001 Haryana

E-2/215, Shastri Nagar, New Delhi - 110052

9138077750, 9138177750,

9138277750, 9138377750,

9138477750