Hindu Undivided Family (HUF) is a unique concept in Indian law that allows the financial assets of family members to be combined under a single entity. It is important for effective taxation.

This blog aims to help readers understand the complexity of HUF, and its significance in tax planning so that you can reduce your Tax by making HUF so that families make the best financial decisions.

Understanding HUF

According to Indian law, a HUF is a recognized group of families composed of ancestors and their descendants who share a common property. A HUF Deed explains the way it is formed and operates.

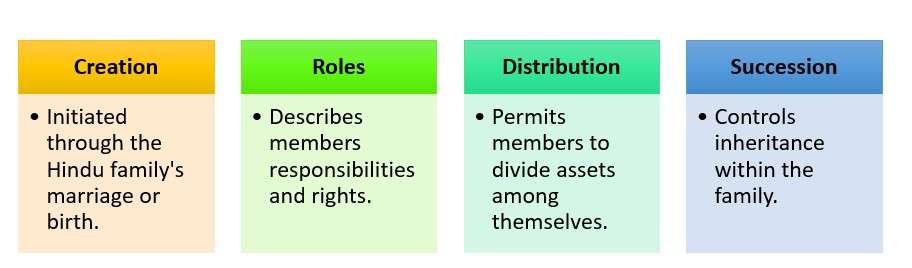

Components of HUF Deed

Legal Requirements for creating a HUF Deed involve drafting a document that specifies formation, roles, and succession, according to law.

Tax Benefits of Creating HUF

Here is a list of tax benefits obtained by HUFs:

They effectively reduce their taxable earnings by increasing deductions by strategically allocating expenses leading to maximum tax savings.

The splitting of income and expenses among family members of HUF is made possible by proper allocation, resulting in a reduction in the total tax bill.

How to Create an HUF Deed?

Creating a Hindu Undivided Family (HUF) Deed involves key steps.

Seek guidance from tax professionals for clarity on legal requirements and tax implications.

Draft the HUF Deed that outlines the roles and responsibilities of family members.

This process requires details of the Karta (head), family members, and their shares.

After this, register the deed with the Registrar of Companies.

Tax Saving Strategies with HUF Deed

- Within a Hindu Undivided Family (HUF), ancestral property offers several tax advantages such as transfer exclusion from the capital gain tax.

- Reducing the effect of taxes on heirs can be achieved by carefully structuring the transfer of ownership inside the HUF.

- HUFs can make use of the tax benefits and deductions granted by the Income Tax Act under several provisions, including medical expenses and income relief.

Case Studies and Examples

Mr.Rajesh earns Rs 20 lakh and receives a property that demands Rs 7.5 lakh rent yearly. Apart from his earnings,the HUF has a decreased tax on rent reducing the overall tax burden.

| Income from various sources | HUF’s Return | ||

| Income of Mr.Rajesh before formation of HUF | Income of Mr.Rajesh before the formation of HUF | Income of HUF | |

| A) Salary | 20,00,000 | 20,00,000 | |

| B) House property rent | 7,50,000 | – | 7,50,000 |

| C) Standard deduction on house property (30% of 7,50,000) | (2,25,000) | – | (2,25,000) |

| D) Income from house property (B-C) | 5,25,000 | – | 5,25,000 |

| Total taxable income (A+D) | 25,25,000 | 20,00,000 | 5,25,000 |

| Section 80C | (1,50,000) | (1,50,000) | (1,50,000) |

| Net taxable income (E-F) | 23,75,000 | 18,50,000 | 3,75,000 |

| Tax payable (calculations based on Slab rates of the old regime including health and education cess of 4%) | 5,46,000 | 3,82,200 | 6,500 |

| Total tax paid by Mr.Rajesh | 5,46,000 |

| Total tax paid by Mr.Rajesh& HUF | 3,88,700 |

| Tax saving due to forming an HUF | 1,57,300 |

Comparison: Without HUF, all income gets combined in Mr. Rajesh’s tax rate, making him pay more tax. But with a HUF, the rent income is taxed separately, which may help Rajesh by putting him in a lower tax category and resulting in savings.

Legal and Compliance Aspects

- Compliance requirements for HUF organizations include adhering to tax laws and maintaining proper records.

- Tax filing and reporting for HUF involve timely filing of returns, disclosing all sources of income, and claiming all available deductions.

- To resolve disputes and disagreements within HUF, one needs to stick to legal guidelines and record agreements.

Conclusion

HUF allows families to manage their finances and handle their tax responsibilities. It is an effective method to achieve tax benefits and financial savings. We strongly advise you to learn more about this potential tax benefit. Don’t miss the chance to get this important asset for the financial future of your family.

Frequently Asked Questions (FAQs)

A. Who can create a HUF and become its member?

A Hindu, Sikh, Jain, or Buddhist family where all members are related by blood or marriage and live together can create a Hindu Undivided Family (HUF).

B. Can a HUF avail of all tax deductions and exemptions available to individuals?

HUF can receive individual tax deductions and exemptions provided by the Income Tax Act.

C. What happens to the HUF when the Karta (manager) dies?

Upon Karta’s death, the next eldest male member becomes the new Karta. If there is no male member, HUF dissolves, and property is shared among members.

D. Can the Husband and Wife create a HUF?

Husband and wife can create a HUF with their children, and at least need one more family member.

Leave A Comment