Forms 15G and 15H are self-declaration forms provided for those who fail to satisfy certain income and age requirements.

By being aware of these forms, individuals can boost their savings by avoiding unnecessary TDS deductions. The purpose of this blog is to make Forms 15G and 15H easier to understand to ensure readers efficiently manage their taxes.

Overview of Form 15G and Form 15H

Form 15G and Form 15H are the self-declaration forms submitted by individuals to banks/financial institutions to declare that their income is below the taxable limit.

These forms help people prevent TDS deducted from their salary, particularly those with low incomes such as students, senior citizens, or freelancers.

Eligibility criteria for submitting Form 15G and Form 15H:

- Form 15G is filed by a Resident Individual or HUF or trust or any other assessee but not a company or a firm with age less than 60 years and having an income below the taxable limit.

- Form 15H is submitted by Resident senior citizens (over 60 or 65 years old, depending on the correct tax bracket).

Key differences between Form 15G and Form 15H

| Form 15G | Form 15H |

| Form 15G is for individuals other than senior citizens. | Form 15H is reserved only for older persons. |

| Form 15G can be filed if the total amount of taxable income is less than the basic exemption level(₹.2.5 lakh in the old regime and ₹.3 lakh in the New Regime). | Form 15H can only be filed if the tax calculated on the entire income is zero. |

Purpose and Usage of Form 15G and Form 15H

For people with lower incomes, these forms are beneficial since they save them from the stress of collecting their refunds later.

Form 15G and Form 15H are used to avoid TDS deductions on income like interest, dividends, etc., for individuals whose total income falls below taxable limits.

These forms serve as declarations by individuals (15G for those below 60 years, 15H for senior citizens) It’s especially helpful for those with income from interest on savings, fixed deposits, or recurring deposits.

It requires having a valid Permanent Account Number (PAN) and being an Indian citizen. In addition, your entire income must not be above the basic exemption limit.

Who Can Submit Form 15G and Form 15H?

Individuals under 60 years of age with taxable income below the exemption limit can submit Form 15G to prevent TDS deduction on interest income.

Senior citizens aged 60 years or above can submit Form 15H if their tax liability is zero on total income.

Both forms have limitations:

They can only be submitted by individuals, not companies or firms. Also, false information can lead to costly penalties.

How to Fill and Submit Form 15G and Form 15H?

Following these simple steps ensures the smooth submission of Form 15G and Form 15H:

Step-by-step guide to filling out the forms

- You can download Form 15G and Form 15H from the Income Tax Department website or get them from your bank or financial institution.

- Fill details such as name, PAN, address, and contact.

- Provide information about your income, including sources such as interest, dividends, and any other earnings.

- Read the declaration form carefully and then sign.

Submission process of forms to banks, financial institutions, and employers:

- Take the completed forms to the desired organization, and get the information provided verified.

- Organizations can ask for additional documents if required.

- Acknowledged receipt will be provided after verification.

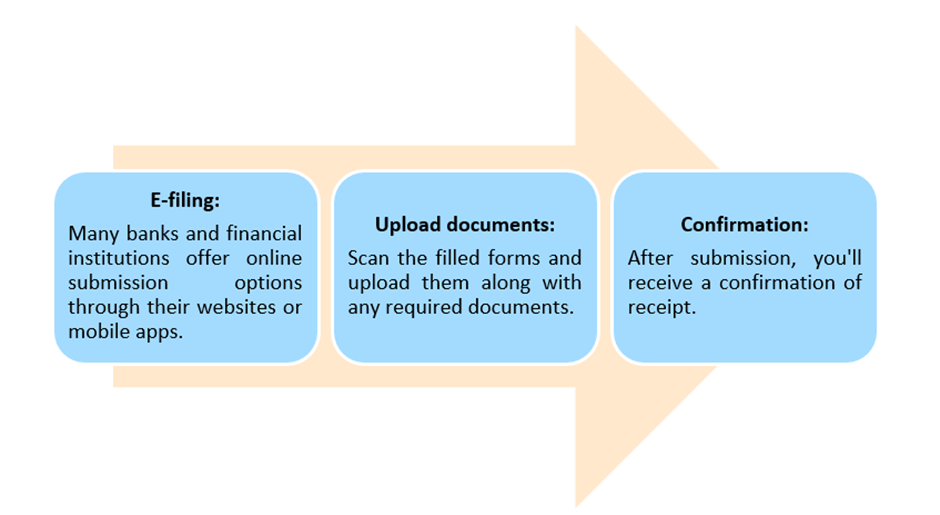

Online submission options and procedures:

Benefits of Submitting Form 15G and Form 15H

- These forms bring financial benefits and ease tax-related responsibilities for eligible candidates.

- Individuals can avoid TDS deductions on their income.

- They simplify tax compliance, making the process less time-consuming.

Risks and Considerations

- Providing false information on Form 15G or Form 15H can lead to costly fines.

- Filling the forms correctly will reduce your tax burden and improve tax planning strategies.

- Form 15G and Form 15H need to be renewed and re-submitted each financial year.

Frequently Asked Questions (FAQs)

What is the validity period of Form 15G and Form 15H?

Form 15G and Form 15H are valid for one financial year. You need to submit a new one each year to avail of tax benefits

Can Form 15G and Form 15H be submitted for all types of income?

Form 15G and Form 15H can only be submitted for certain types of income like interest on savings, dividends, etc., but not for salary income.

What to do if TDS is already deducted despite submission of Form 15G/15H?

If TDS is deducted despite submitting Form 15G/15H, you can claim a refund by filing an income tax return.

Case Studies and Example(Considering Old Regime):

| Age | 50 years | 22 years | 64 years | 67 years |

| Salary | Rs. 1,80,000 | – | – | – |

| Pension | – | – | Rs. 1,00,000 | – |

| FD interest income | Rs. 80,000 | Rs. 2,65,000 | Rs. 1,80,000 | Rs. 3,30,000 |

| Total income before Section 80 deductions |

Rs. 2,60,000 | Rs. 2,65,000 | Rs. 2,80,000 | Rs. 3,30,000 |

| Deductions under Section 80 |

Rs. 40,000 | Rs. 35,000 | Rs. 10,000 | Rs. 55,000 |

| Taxable income | Rs. 2,20,000 | Rs. 2,30,000 | Rs. 2,70,000 | Rs. 2,75,000 |

| Minimum exempt income |

Rs. 2,50,000 | Rs. 2,50,000 | Rs. 3,00,000 | Rs. 3,00,000 |

| Age | less than 60 years | less than 60 years | more than 60 year | more than 60 year |

| Tax on total income is Nil | Yes | Yes | Yes | Yes |

| Interest income is less than basic exemption limit | Yes | No | N.A. | N.A. |

| Eligible to submit Form 15G/15H |

Form 15G | Cannot Submit | Form 15H | Form 15H |

Conclusion

Form 15G and Form 15H prevent unnecessary tax deductions for eligible individuals. By submitting them accurately, one can explore tax-saving opportunities, and retain more earnings. Take the help of professionals like Rebus, to maximize your savings.

Leave A Comment